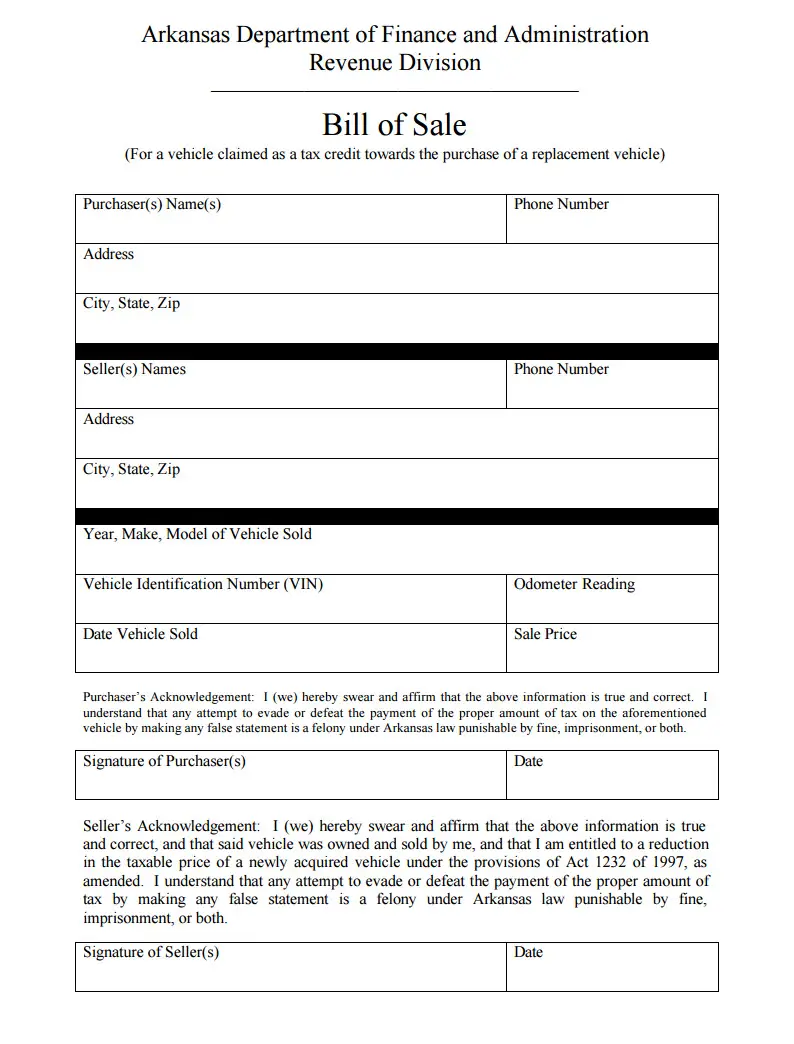

If you are selling or buying a motor vehicle in Arkansas, you will need to complete the state-approved bill of sale to apply for the tax credit on the sale.

In Arkansas, a bill of sale is a legal document provided by the Arkansas Office of Motor Vehicles (OMV) to document the sales transaction between a seller and a purchaser.

The Arkansas bill of sale clearly states that on a specific date, for a particular amount, the seller transfers ownership of the vehicle to the purchaser.

Note: If you wish to use the bill of sale for other valuable assets, such as a boat, trailer, or motorcycle, you can use our corresponding bill of sale templates specifically designed for these types of assets.

We also provide a blank bill of sale if you don’t find a specific bill of sale form for the item you want to sell.

Arkansas OMV accepts a complete title instead of a bill of sale document, but they require the bill of sale in the following situations:

- The seller wants to apply a tax credit for the sale of the used vehicle. If the seller wants to register the new vehicle that replaces the sold one within 45 days, either after or before the seller acquires the new vehicle, the seller can apply for a sale tax credit. Arkansas OMV clearly outlines the procedure for applying the criteria and obtaining the tax credit at the end of the bill of sale.

- The purchaser who wants to register the used vehicle needs to have a completed title. The bill of sale serves as backup paperwork in case the title has any issues, such as errors made by the seller. In addition, the bill of sale provides the purchaser with information that is not available in the title, such as the seller’s phone number. Therefore, it is essential for the purchaser that a completed title is required to complete the sale, whether or not a bill of sale is included.

Arkansas OMV requires both seller and purchaser to complete the following information on the bill of sale:

- Both the seller and purchaser provided detailed information, including name, phone number, address, city, zip code, and state.

- Information on the vehicle: Year, Make, Model, Vehicle Identification Number (VIN), odometer reading

- Date when the vehicle is sold and the sale price

- Signatures of both seller and purchaser. Arkansas OMV does not require the bill of sale to be notarized.

- Two sections contain the seller’s and purchaser’s acknowledgments regarding the information on the bill of sale and the fine, if any party attempts to evade payment of tax.

Both the purchaser and seller should retain a completed copy of the bill of sale.

To use the Arkansas bill of sale, you must first download, open, and print it out. Then you fill out all the necessary information and sign the bill.